This blog provides elliott waves counts for Nifty Benchmark Index. PRIMARY Purpose of this blog is to provide education on elliott waves. But trade/invest @ ur own RISK.

Tuesday, September 13, 2011

Tuesday, August 23, 2011

Respect elliott wvae priciple.

Respect the channels..

Respect Fibonacci Ratios...Say Golden Ratio...

There r times when Wave principle itself clashes with short term wave counts

say most elliticans r saying break of 4800 without any bounce is likely but my view is different as i don't wbnt to consider short-term wavecounts in front of wave principle.

Tuesday, August 16, 2011

Friday, August 12, 2011

Thursday, August 11, 2011

Tuesday, August 9, 2011

Monday, August 8, 2011

Saturday, August 6, 2011

Last bet on old counts

Even after huge negatives, i want to place last bet on this count.

But this count is of no use if NIFTY closes below 5180.

Rest, wave 2 retraces wave 1 by 100+% + Wave 3 is the smallest in this count.

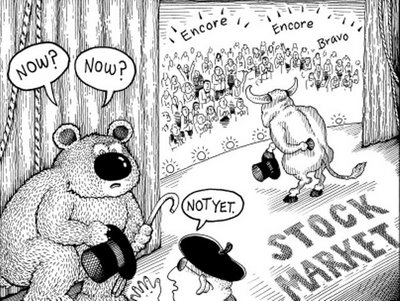

Everyone saying BEAR so if u want to sell (create shorts) then try to hedge ur positions by taking call options in ur portfolio.

Trend!

NIFTY: BULL!

Dow jones: BEAR!

Note: Investment in equities includes RISK of LOSS of INVESTMENT.

Friday, August 5, 2011

Thursday, August 4, 2011

Termination in zigzag

Zigzag as wave 2 of WAVE 5 (AUGUST 4)!!!

Why the c wave was terminated/failed to move above wave A????

Target for wave C was above wave A but it failed & thus it was also not possible to sell @ high.

But the reason is within the wave structure. Yes! GOLDEN RATIO is the answer i.e.

wave A was too much stretched that there was no space for wave c to occur.

Wednesday, August 3, 2011

Tuesday, August 2, 2011

2 August 2011

Buy near 5450 with stop-loss of 5-10 points.... or one can reverse position below 5440

Monday, August 1, 2011

Rectangular Vs Trianguler Bull Flags

Rectangular flags r more bullish than triangular flags in terms of uptrend after the BULL FLAG Formation.

Prive Gaps act like magnets

Todays upmove (+ve opening) filled the old price gap while day dragging filled todays price gap.

Next move will depend on any movement above/below todays range which is created by gaps.

Sunday, July 31, 2011

If nifty falls (extension) then 5400 & 5300 is the target but consider this as last fall. Best is to buy above the channel instead trying buy @ lows. Note: Trend is friend, buy costly but with confidence.

Rest, this is last correction and any breakout above the channel must take nifty/sensex to new highs.

Film Release: Loot Lo INDIA

http://sunkey.co.in/2011/06/loot-lo-india-new-indian-movie-release/

Are u saying, I m proud to be an INDIAN?

Are u saying, I m proud to be an INDIAN?

US debt crisis and DLF, Bharti results to impact mkt this week

Dow Jones Industrial Average

DJIA UPDATE: Well! I don't track djia @ depth but i do track many elliott wave blogs so that i can update my counts or switch to alternate counts.

DJIA EW Count suggest that the view of RUNNING TRIANGLES is near complete & THE NEXT DIRECTION IS UPWARD WHICH IS LIKELY EQUIVALENT TO THE THRUST FORMED BY THE TRIANGLES. @ E of triangles, usually followed by a news event specially in case of bigger formations.

So, this suggest that GLOBAL TRADING ENV. is not going to bad for near term & we can expect good days in next few trading sessions.

=============================================================

Triangles!!!! What is the most likely thing of trinagles which can be used to get the point of action @ wave 4 or wave b of zigzag??? Ans: NEWS EVENT

Friday, July 29, 2011

Target is 5553 even if this is downtrending extension. Can be a Small Bear Trap @ wave b of ii (Flat).

Buy Call @ 5555! A=C @ 5560 BUT PATTERN MAY FURTHER EXTEND.

Thursday, July 28, 2011

28 July 2011

Wave started retracing the channel & seems ending but its gud to wait & watch as time frame is not equivalent to a wave...

Wednesday, July 27, 2011

wave v likely to end 10 pts below the channel

Intraday Wave v in progress...

wave iv uptrending

Excellent wave iv, within the channel........It can't break the channel i.e. NO THROWover movement!

Intraday wave iii normal - 27 July 2011

Wave iii (down-trending) just touched the channel but it should not break the channel as its not the extension.

It seems wave iii is near complete but i was expecting a bit more from this wave as the target 5460 is far away from here.

Tuesday, July 26, 2011

Nifty 26 July 2011 (BEAR Trap for MANGO PEOPLE!)

T.V. analyst was bullish yesterday & may be they r bearish today...

Downside is just the trailer, actual downside is pending! T1: 5500, T2: 5400.

The E wave of triangles was SHARP just like A wave of triangles & same is this downside (C WAVE) must not take more time than A of ZIGZAG so the expiry FAVOR BEARS.

Monday, July 25, 2011

Saturday, July 23, 2011

Elliott Wave Short Term Counts for Nifty

Elliott Wave Short Term Counts for Nifty

Wave C can take 3-4 days i.e. Nifty can fall due to RBI Credit Policy (25Pts hike) and it seems last hike.

Refer the Targets shown in the chart. I m tracking nifty in depth frm feb 10 & i don't know why but i m quite sure about this happening. So, best of luck, if anything goes wrong then S-L is also given in the above chart.

(25 July 2011 - Monday)

Labels:

BSE,

Elliott waves,

futures,

investment,

Nifty,

NSE,

options,

prediction,

Stock Market,

stocks,

trading

Subscribe to:

Posts (Atom)