Respect elliott wvae priciple.

Respect the channels..

Respect Fibonacci Ratios...Say Golden Ratio...

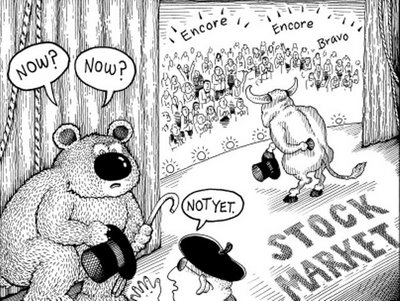

There r times when Wave principle itself clashes with short term wave counts

say most elliticans r saying break of 4800 without any bounce is likely but my view is different as i don't wbnt to consider short-term wavecounts in front of wave principle.